Price

Simple pricing

Principle

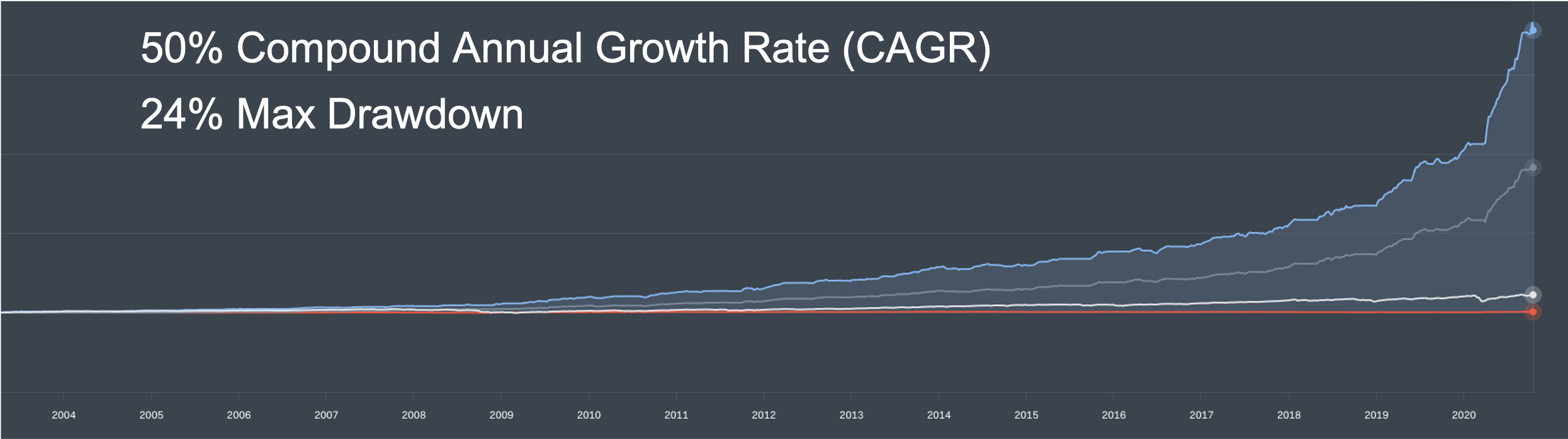

Exit the market when risk is high, otherwise stay in the market with a mix of great trading strategies. Managing risk is our top priority.

Goal

Great return, low drawdown, in LONG term.

Relief

Simple signal, easy to follow, with confidence.

FAQ

- Trading frequency?

- Low. Usually <7 trades in one month. - How are the trading signals delivered?

- By email. - What to trade?

- Usually Nasdaq-100 ETFs, such as QQQ, QLD, TQQQ; or NQ/MNQ futures. It is also based on your risk tolerance and account type. Details are in signal emails. We are also planning for other trading vehicles in separate strategies. - If too many people follow, will the strategy be invalid?

- Nasdaq-100 related products and their underlying holdings have HUGE trading volumes, similar to those of S&P 500. Our scale is so small compared to the market, and our strategy's trading frequency is low. No impact has been observed. However, we still limit the number of strategy subscribers to ensure a high quality. - When is the trading signal sent, on each trading day?

- Usually 30 minutes before market close. - Is your strategy IRA-friendly?

- Yes! It is low-frequency, long-only stock trading. You can use it for 401k, Roth IRA or traditional IRA accounts. - How are the signals generated?

- AI-powered. The signals may be weird for humans' understanding, but it makes profit and has low drawdown in the LONG run. We may publish more info in the signal email in the future. - How much money should I put in the strategy?

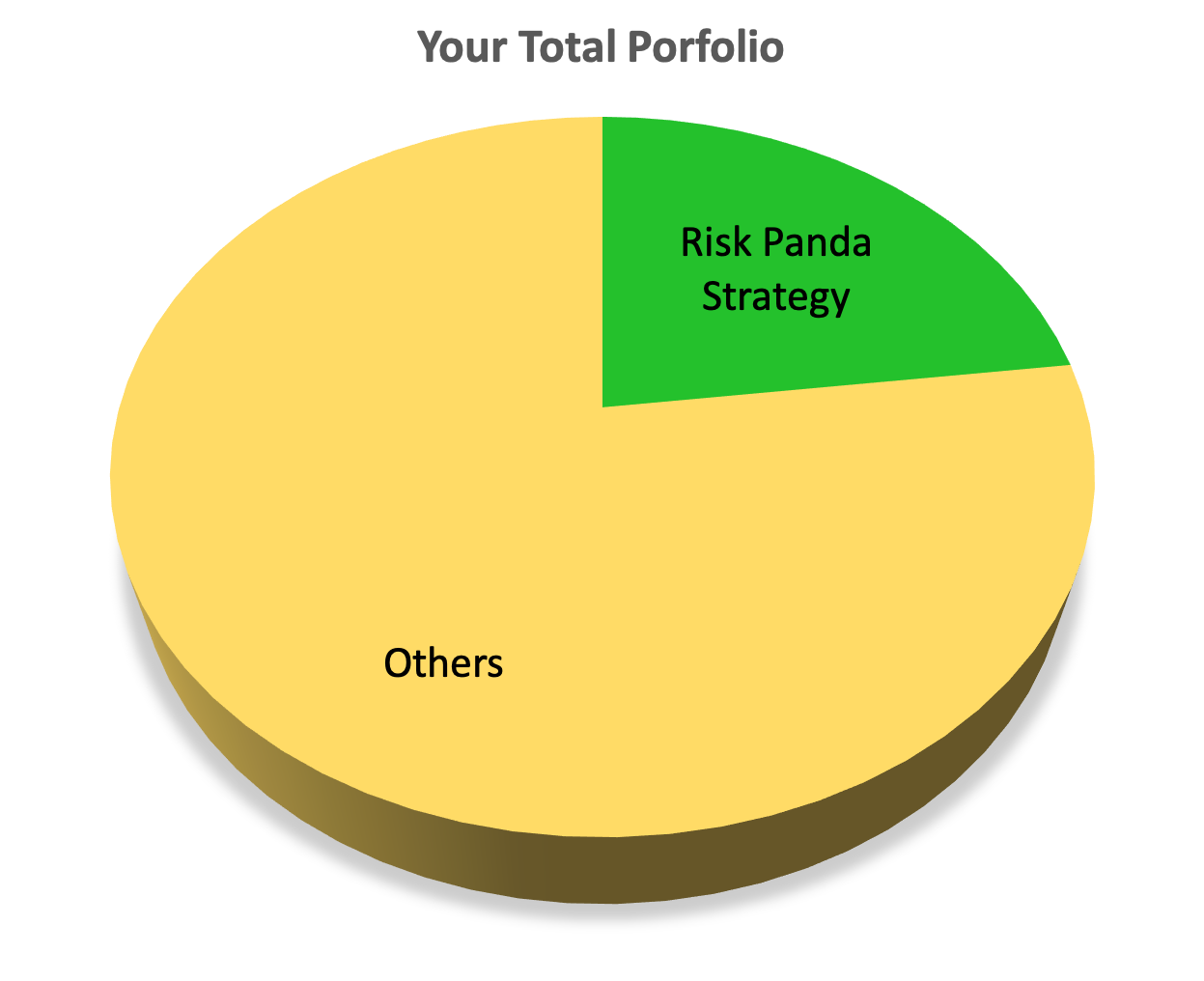

- Invest with a small portion of your total portfolio. This amount of money should not affect your sleep. Otherwise it's easy to not follow the strategy strictly, leading to poor performance. - Can I use the signal to trade my own stocks?

- You can regard the signal as a market safety indicator (risk engine in hedge funds) and trade your own stocks, if you are a very experienced trader. - How long has the strategy existed?

- We combine multiple trading strategies together. The backtesting is back to 1985~2003 for different ones. The real trading started from 2012 (end of 2011, actually). - Do you have other strategies?

- Yes. We are rolling out more strategies for our members to follow. Members will receive notifications. - I'm in Europe, do I have similar trading vehicles?

- Yes. Please look at the following website for ETF alternatives from Europe: https://europoor.com/how-to-buy-leveraged-etfs-from-europe/

Contact

Any question or feedback, contact us!